Building Safer Communities Together

Financing the Future of Energy Efficiency and Seismic Safety

San Francisco Seismic Retrofit Program

Earthquake Safety Implementation Program (ESIP) is a thirty year plan to implement the recommendations of the CAPSS study, completed in 2010. ESIP began in late 2011 under the City Administrator’s office and continues on today to make San Francisco a more prepared, safer, and resilient city. ESIP estimates there are 111,562 San Francisco residents (13.3% of the pop) that live in buildings subject to a soft story condition

On the anniversary of the 1906 San Francisco Earthquake, Mayor Ed Lee signed into law the Mandatory Retrofit Ordinance. This legislation requires the evaluation and retrofit for “multi-unit soft-story buildings,” defined as:

- Wood frame construction (Type V)

- Application of permit for original construction was prior to January 1, 1978

- Five or more residential units

- Two or more stories over a basement or underfloor area that has any portion extending above grade

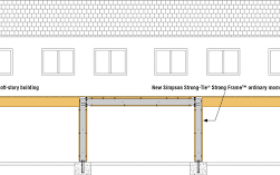

- A soft story condition that has not been seismically strengthened to the standards set forth in the ordinance.

Not Just a Safer Building, A Greener Building

From solar panels to HVAC, there are thousands of PACE eligible improvements you can make to your property. CounterpointeSRE financing can cover energy efficiency, renewable energy, or risk mitigation improvements. Take this opportunity to find ways to not only improve property safety, but also lower energy costs and increase the value of your property.

Finance Your Soft Story Retrofit In 4 Easy Steps

Apply for the Seismic Retrofit Program

Property Owners qualify for the Program based on the equity in the property and certain underwriting criteria

Start by completing a short form via our website application.

Once application is accepted, you will be able to create a web account.

The web account includes information about the Program, Registered Professionals in your area and resources such as guides and other eligible water conservation or energy efficiency improvements.

Once you are prequalified, continue your application.

Upload required documents for underwriting via your web account.

Receive Financial Approval up to Maximum Assessment Amount.

Select your Engineer or Contractor from our list of eligible Registered Professionals or ask your professional to apply to our Program.

Financing is subject to financial and technical approvals and to entering into an assessment contract which will set forth the interest rate and other terms and conditions.

Final approval of your application is subject to technical approval of your proposed project.

Develop the retrofit plan and submit to SFDBI for approval

Submit your engineer's plans for an earthquake sensitivity analysis (SEL report).

Submit your contractor's proposal for PACE technical approval of costs and any other improvements.

Make arrangement with our Program to close your assessment and arrange payment schedule.

Begin your Seismic Retrofit

The Program can provide Progress Payments to your Registered Professionals and reimburse you for your expenses.

Soft Costs of construction can be included in your financing: permits, inspections, design, financing costs, plans, etc.

A final Assessment amount will be recorded at the Tax Collectors office.

You will receive an addtional line item on your regular property tax bill from the city for the Assessment payment. Payments are only made through your property tax bill.

Assessment can transfer to new owner should you sell the property.