Financing the Future Of Energy Efficiency and Resiliency

Counterpointe Sustainable Real Estate has the commercial real estate expertise to help project developers, owners, mortgage bankers/brokers and other commercial real estate professionals

UTILIZE YOUR CAPITAL MORE EFFICIENTLY

100% financing of improvements including financing costs and any prepaid service contracts

Lower operating costs from energy efficiency improvements

Depending upon lease structure, may pass-through costs as operating expenses, property tax reimbursement

First payment may be deferred for up to 2 years by capitalizing interest in the financing

Previously completed project may be eligible for financing in some jurisdictions

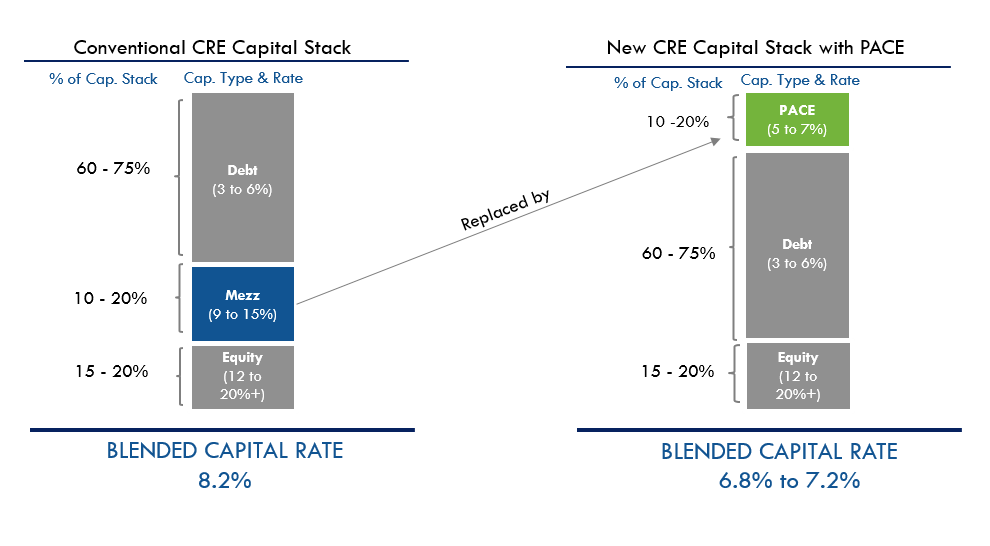

LOWER COST OF CAPITAL THAN EQUITY OR MEZZANINE DEBT

Fixed rate, long-term financing with no balloon payments

Self-amortizing during term

Owner retains tax incentives, rebates, deductions and depreciation for the improvements

May receive off balance sheet treatment

Improves property cash flow through overall capital cost and utility expense reductions

No acceleration clauses and fully transferable if property is sold

Non-recourse with simple documentation and no technical default provisions

WHY PACE ?

CHALLENGE #1

Most commercial real estate accounting use separate Capital and Operating Budgets

- Savings from reducing operating costs not applied towards improvements, but towards other capital investments

- Cost of improvement over estimated useful life not considered in budgets

- Net annual cash flow is crticial issue to owners

The CounterpointeSRE Solution:

- 100% financing: no capital expenditure or upfront costs to owners for the improvement

- Long amortization schedule with fixed rates keeps savings to investment ratio greater than one.

CHALLENGE #2

Commercial Real Estate Owners want to increase return on investment (ROI) for green building improvements

- Split Incentives for Owner and Tenants

- Owner pays cost for improvement and often only the tenant gets benefit through utility savings

- High turnover rates with many buildings sold before savings are realized

The CounterpointeSRE Solution:

- No upfront costs to owners

- Pass-through costs to tenants as permitted by lease as assessment repaid through property tax bill

- Some rent control laws permit pass-through to tenants

- Assessment stays on property if sold

(855) 431-4400

More information can be found in FAQ section here